What is an Accounts Payable Audit?

Top of Page

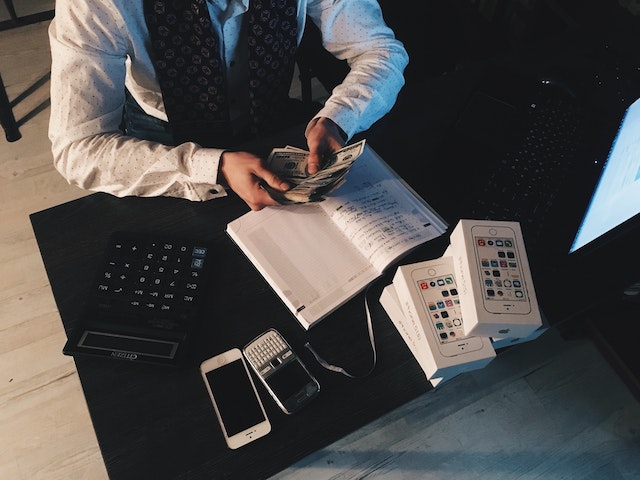

An accounts payable audit is a comprehensive examination of a company's accounts payable function and processes. It involves reviewing the company's financial records, invoices, payment transactions, and related documentation to ensure accuracy, compliance with policies and procedures, and adherence to accounting standards.

In today's business landscape, effective financial management is crucial for organizations striving to maintain a competitive edge. One aspect that deserves careful attention is accounts payable recovery. Often overlooked, accounts payable recovery represents an opportunity for companies to optimize their cash flow, reduce financial leakage, and enhance overall operational efficiency.

The primary objective of an accounts payable audit is to identify any errors, irregularities, or inefficiencies within the accounts payable process. This audit helps ensure that the company's financial statements present a true and fair view of its financial position, and that the company is properly managing its financial obligations to suppliers, vendors, and creditors.

During an accounts payable audit, auditors typically perform the following activities:

1. Reviewing invoices and supporting documents: Auditors examine invoices, purchase orders, receiving reports, and other relevant documents to verify the accuracy of recorded transactions and ensure that proper authorization and documentation are in place.

2. Assessing internal controls: The effectiveness of internal controls and segregation of duties within the accounts payable function are evaluated. This includes assessing procedures for approving invoices, processing payments, and reconciling accounts.

3. Examining payment processes: Auditors review payment processes to ensure adherence to company policies and procedures. They verify that payments are properly authorized, accurately recorded, and made in a timely manner.

4. Analyzing vendor records: Auditors analyze vendor records and account balances to confirm the existence of vendors, validate their information, and ensure that payments are being made to legitimate entities.

5. Testing for compliance: Auditors assess compliance with relevant laws, regulations, and accounting standards governing accounts payable. This includes evaluating tax compliance, vendor contract compliance, and adherence to financial reporting requirements.

6. Identifying errors and irregularities: Any errors, discrepancies, or potential fraudulent activities identified during the audit are thoroughly investigated. Auditors may also recommend process improvements to enhance efficiency and effectiveness.

|

The outcome of an accounts payable audit is a report that summarizes the audit findings, identifies any deficiencies or areas of concern, and provides recommendations for improvement. This report is typically shared with management and stakeholders to facilitate corrective actions and strengthen the company's internal control environment.

Understanding Accounts Payable Recovery

Top of Page

Accounts payable recovery refers to the process of identifying and reclaiming funds owed to a company that have been previously overlooked or mishandled. These funds typically result from a variety of sources, such as duplicate payments, overpayments, vendor credits, unapplied cash, and pricing errors. By actively pursuing accounts payable recovery, businesses can regain lost revenue, improve working capital, and foster stronger vendor relationships.

|

Top of Page

To better understand accounts payable audits, you can take the following steps:

1. Study Relevant Accounting and Auditing Principles: Familiarize yourself with fundamental accounting concepts and principles, as well as auditing standards and procedures. This will provide you with a strong foundation for understanding accounts payable audits.

2. Read Accounting and Audit Literature: Explore books, articles, and publications that specifically cover accounts payable audits. Look for resources that explain the objectives, methodologies, and best practices associated with these audits.

3. Review Audit Standards and Guidelines: Familiarize yourself with relevant audit standards and guidelines, such as those issued by the International Auditing and Assurance Standards Board (IAASB) or the American Institute of Certified Public Accountants (AICPA). These standards outline the expectations and requirements for conducting effective accounts payable audits.

4. Attend Training and Workshops: Consider attending workshops, seminars, or training programs focused on auditing, specifically in the context of accounts payable. These events often provide insights into industry practices, case studies, and practical tips for conducting audits.

5. Engage in Continuing Professional Development (CPD): Participate in CPD programs related to accounting, auditing, or financial management. This will help you stay up to date with evolving audit techniques, regulations, and best practices in the field of accounts payable audits.

6. Seek Practical Experience: If possible, try to gain practical experience by working alongside auditors or professionals involved in accounts payable audits. This can be done through internships, job rotations, or by engaging with auditors in your organization.

7. Engage in Online Communities: Join online forums, discussion boards, or professional networking platforms where accounting and audit professionals share their knowledge and experiences. Engaging in these communities can help you gain insights and learn from the experiences of others involved in accounts payable audits.

8. Review Sample Audit Reports: Analyze sample accounts payable audit reports to understand the structure, content, and typical findings that auditors identify during the audit process. This will give you an idea of what auditors look for and how they communicate their findings.

9. Consult with Experts: If you have specific questions or areas of confusion regarding accounts payable audits, seek guidance from experts in the field. This could include experienced auditors, accountants, or consultants who specialize in auditing or financial management.

By combining theoretical knowledge, practical experience, and continuous learning, you can develop a better understanding of accounts payable audits and the factors that contribute to their success.

Key Benefits of Accounts Payable Recovery

Top of Page

1. Financial Gain: Accounts payable recovery enables businesses to recoup funds that would otherwise remain lost or unutilised. By identifying and rectifying errors and discrepancies, organizations can bolster their financial position and enhance profitability.

2. Improved Cash Flow: Recovering lost funds from accounts payable directly impacts cash flow. The reclaimed funds can be reinvested or used to meet immediate financial obligations, reducing the need for additional borrowing and associated costs.

3. Enhanced Vendor Relations: Accounts payable recovery encourages close collaboration with vendors. By proactively addressing payment issues, businesses demonstrate their commitment to accuracy and fairness, fostering trust and strengthening partnerships.

4. Process Optimization: The pursuit of accounts payable recovery necessitates a thorough examination of existing financial processes. This evaluation often leads to the identification of inefficiencies and the implementation of streamlined procedures, resulting in improved overall financial management.

Effective Strategies for Accounts Payable Recovery

Top of Page

1. Automated Invoice and Payment Systems: Implementing advanced software solutions can significantly reduce the risk of errors and duplicate payments. Automation streamlines invoice processing, enhances accuracy, and provides real-time visibility into payment status, facilitating prompt issue identification and resolution.

2. Regular Audits and Reconciliation: Conducting periodic audits and reconciliations is essential for identifying and rectifying payment discrepancies. This involves cross-referencing invoices, purchase orders, and payment records to detect errors, overpayments, and unapplied cash.

3. Vendor Communication: Establishing open lines of communication with vendors is vital for successful accounts payable recovery. Proactive engagement allows for timely issue resolution, enables the efficient processing of credits, and enhances overall vendor relations.

4. Data Analysis and Reporting: Leveraging data analytics tools can help identify trends and patterns in accounts payable, making it easier to spot anomalies and potential recovery opportunities. Robust reporting capabilities provide insights into key performance indicators, facilitating informed decision-making.

What Differentiates an Accounts Payable Audit?

Top of Page

An Accounts Payable (AP) audit is a thorough review and examination of an organization's accounts payable processes, financial records, and transactions. The primary objective of an AP audit is to ensure accuracy, compliance, and efficiency within the accounts payable department. This type of audit is typically conducted by internal or external auditors to provide an independent assessment of an organization's financial operations. Here's a breakdown of its key aspects:

1. Accuracy of Financial Records: Auditors scrutinize the accuracy of financial records related to accounts payable. This includes verifying that invoices, purchase orders, and payment documentation are correctly recorded and match corresponding transactions.

2. Invoice Verification: Auditors verify that invoices received from vendors match the goods or services received and the terms outlined in purchase orders or contracts. This process ensures that the organization is only paying for legitimate and authorized expenses.

3. Duplicate Payment Detection: One of the primary goals of an AP audit is to identify any instances of duplicate payments. This involves cross-referencing payment records to detect any payments made more than once for the same invoice.

4. Internal Control Assessment: Auditors assess the effectiveness of internal controls within the accounts payable process. This involves evaluating segregation of duties, approval processes, and the overall workflow to identify any vulnerabilities that could lead to errors or fraud.

5. Compliance Check: The audit also involves checking whether the organization is adhering to internal policies, industry regulations, and relevant accounting standards. This ensures that financial transactions are conducted in a manner that aligns with legal and regulatory requirements.

6. Vendor Master File Review: The audit may include a review of the vendor master file to ensure that vendors listed are legitimate and authorized. This helps prevent fraudulent or unauthorized vendors from being paid.

7. Payment Terms Verification: Auditors confirm that payment terms (such as discounts for early payment) are correctly applied and that the organization is taking advantage of any available cost-saving opportunities.

8. Process Efficiency: Apart from accuracy and compliance, the audit also examines the efficiency of the accounts payable process. This involves evaluating the timeliness of payments, streamlining of workflows, and the overall effectiveness of the AP department.

9. Reporting and Recommendations: Following the audit, auditors provide a comprehensive report that outlines their findings, including any instances of errors, discrepancies, or control weaknesses. They may also provide recommendations for process improvements and strengthening internal controls.

10. Fraud Detection: While not the primary focus, an AP audit can also help in detecting potential fraudulent activities such as fictitious vendors or unauthorized payments.

Overall, an Accounts Payable audit plays a crucial role in maintaining the financial health of an organization. It helps identify and rectify errors, prevent financial losses, enhance efficiency, and ensure compliance with financial regulations.

When Would I Carry Out an Accounts Payable Audit?

Top of Page

An Accounts Payable (AP) audit can be carried out at various times depending on your organization's needs and circumstances. Here are some key instances when you might consider conducting an AP audit:

1. Regular Audits: Many organizations schedule regular AP audits as part of their internal control and risk management processes. This could be an annual or bi-annual practice to ensure that the accounts payable function is operating accurately, efficiently, and in compliance with relevant regulations.

2. System Implementations or Upgrades: When implementing new accounting software or upgrading existing systems, an AP audit can be beneficial. It helps verify the accuracy of data migration, ensures that the new system aligns with the organization's requirements, and identifies any potential issues early on.

3. Mergers and Acquisitions: During mergers or acquisitions, combining financial processes and systems can be complex. An AP audit can help streamline the integration of accounts payable functions, identify duplicate payments, and ensure consistency in processes across the newly merged entities.

4. Process Improvement Initiatives: If you're aiming to improve the efficiency of your accounts payable processes, conducting an audit can provide valuable insights into areas that need enhancement. This can help you identify bottlenecks, reduce processing times, and optimize workflows.

5. Suspected Irregularities or Fraud: If there are suspicions of irregularities, fraudulent activities, or instances of duplicate payments, an AP audit can help uncover the root causes and quantify the extent of the issue.

6. Regulatory Compliance Requirements: Certain industries are subject to strict regulatory requirements. Regular AP audits can help ensure compliance with industry-specific financial regulations, such as Sarbanes-Oxley (SOX) for publicly traded companies.

7. High Vendor Turnover: If your organization has a high turnover of vendors or a large number of transactions, the risk of errors, duplicate payments, or fraud increases. Conducting regular or periodic AP audits can help mitigate these risks.

8. Cost Reduction Initiatives: When looking to reduce costs, an AP audit can identify areas where savings can be achieved, such as by optimizing payment terms, negotiating better vendor discounts, or eliminating unnecessary expenses.

9. Preparing for External Audits: If your organization is expecting an external audit, conducting an AP audit beforehand can help ensure that your accounts payable processes and records are accurate and compliant, reducing potential issues during the external audit.

10. Changing Business Conditions: Significant changes in your business, such as rapid growth, downsizing, or restructuring, can impact your accounts payable processes. An AP audit can help ensure that these processes remain effective and adaptable to changing conditions.

Remember, the timing of an AP audit depends on your organization's specific needs and goals. It's important to assess your operational context and determine the most appropriate timing for conducting an audit to derive the maximum benefits.

What is the Purpose of Conducting an Accounts Payable Audit?

Top of Page

Conducting an Accounts Payable (AP) audit serves several important purposes for an organization. Here are the primary reasons why organizations carry out AP audits:

1. Accuracy and Validation: An AP audit ensures the accuracy and validity of financial transactions related to accounts payable. It verifies that invoices, purchase orders, and payment records are correctly recorded and match the goods or services received. This helps prevent errors, discrepancies, and fraud.

2. Fraud Prevention and Detection: AP audits play a crucial role in identifying fraudulent activities such as duplicate payments, fictitious vendors, or unauthorized transactions. By scrutinizing payment records and vendor information, auditors can detect irregularities and potential instances of fraud.

3. Compliance Assurance: Compliance with internal policies, industry regulations, and accounting standards is essential for organizations. An AP audit ensures that the accounts payable processes adhere to these requirements, reducing the risk of legal and regulatory violations.

4. Duplicate Payment Detection: One of the primary objectives of an AP audit is to identify and recover duplicate payments. Detecting and recovering these overpayments helps organizations reclaim lost funds, improving their financial position.

5. Process Efficiency and Optimization: AP audits evaluate the efficiency of accounts payable processes. They identify bottlenecks, inefficiencies, and areas for improvement. By optimizing workflows and internal controls, organizations can streamline processes and reduce processing times.

6. Risk Mitigation: Accounts payable is susceptible to various risks, including payment errors, late payments, and compliance breaches. An AP audit helps identify and mitigate these risks by strengthening internal controls, improving data accuracy, and enhancing payment practices.

7. Cost Management: Audits can uncover cost-saving opportunities, such as identifying early payment discount options, negotiating better terms with vendors, and eliminating unnecessary expenses. This contributes to improved financial management and bottom-line savings.

8. Vendor Management: An AP audit involves a review of the vendor master file. This helps ensure that legitimate vendors are listed and unauthorized vendors are not receiving payments. Effective vendor management minimizes the risk of fraudulent or incorrect payments.

9. Process Standardization: In organizations with multiple locations or departments, AP audits help standardize accounts payable processes and ensure consistency across the board. This reduces confusion, minimizes errors, and enhances the organization's overall financial operations.

10. Confidence and Transparency: Conducting regular AP audits demonstrates the organization's commitment to financial accuracy, compliance, and transparency. This enhances stakeholders' confidence in the company's financial reporting and practices.

11. Continuous Improvement: The insights gained from AP audits can be used to implement ongoing improvements in accounts payable processes. By addressing identified issues and incorporating audit recommendations, organizations can continuously enhance their financial operations.

In summary, the purpose of conducting an Accounts Payable audit is to ensure the accuracy, efficiency, compliance, and integrity of financial transactions within the accounts payable function. It helps organizations safeguard their financial resources, prevent fraud, and maintain transparency in their financial operations.

Should an Accounts Payable Audit Be Outsourced for Greater Transparency?

Top of Page

Whether to outsource an Accounts Payable (AP) audit for greater transparency depends on several factors, including the organization's goals, resources, and the level of control desired. Here are some considerations to help you decide:

Pros of Outsourcing:

1. Independent Perspective: External auditors provide an independent and unbiased assessment of your AP processes. This can enhance transparency by reducing potential biases or conflicts of interest that might arise from an internal audit.

2. Expertise: External audit firms specialize in auditing and have deep expertise in AP processes and best practices. This can result in a more comprehensive and efficient audit.

3. Access to Best Practices: Outsourcing can provide insights into industry best practices and benchmarking data, helping you improve your AP processes based on external expertise.

4. Resource Efficiency: Conducting an audit requires time, effort, and specific skill sets. Outsourcing frees up your internal team to focus on core business functions while the audit is being conducted.

5. Minimized Interference: External auditors can often perform their work with less disruption to your day-to-day operations, as they are not directly involved in your organization's routine tasks.

Cons of Outsourcing:

1. Cost: Outsourcing an audit can be more expensive than conducting an internal audit, especially if the scope is extensive or the audit firm charges high fees.

2. Loss of Control: Outsourcing means you have less control over the audit process. You need to rely on the external firm's methodology and timelines, which might not align perfectly with your internal needs.

3. Confidentiality Concerns: Sharing sensitive financial and operational information with an external firm may raise confidentiality concerns. Ensure that the audit firm has strong data protection measures in place.

4. Less Familiarity: External auditors might not be as familiar with your organization's unique operations, culture, and processes, which could impact the depth of insights gained.

Hybrid Approach:

Consider a hybrid approach that combines elements of both internal and external audits. This can involve having your internal team conduct the audit under external guidance, using audit firms as consultants or for specific tasks (e.g., data analysis), or having external auditors review the internal audit's findings.

Key Factors to Consider:

1. Scope and Complexity: If your AP processes are complex or involve multiple locations, outsourcing might provide a fresh perspective and in-depth analysis.

2. Resources: If your internal team lacks the expertise, time, or capacity to conduct a thorough audit, outsourcing can be beneficial.

3. Regulatory Requirements: If your industry is subject to specific regulations, an external audit by a firm with expertise in compliance can ensure you're meeting all requirements.

4. Budget: Consider the cost of outsourcing versus the potential benefits gained in terms of transparency and process improvement.

5. Control vs. Independence: Evaluate whether the benefits of an independent external perspective outweigh the desire for control over the audit process.

In the end, the decision should align with your organization's objectives, resources, and risk appetite. It's advisable to involve key stakeholders, including finance, legal, and senior management, in the decision-making process.

What are the Security Risks of Outsourcing an Accounts Payable Audit?

Top of Page

Outsourcing an Accounts Payable (AP) audit can provide many benefits, but it also comes with potential security risks. Here are some security risks to consider when outsourcing an AP audit:

1. Confidentiality Breach: An AP audit involves sharing sensitive financial and operational information with an external audit firm. There's a risk that this information could be mishandled or accessed by unauthorized individuals, leading to a breach of confidentiality.

2. Data Exposure: The audit process may require providing access to your financial systems, databases, and records. If proper data security measures are not in place, this could expose your organization's critical financial data to cyber threats.

3. Data Breach: If the external audit firm's systems are compromised due to inadequate cybersecurity measures, cybercriminals could gain access to your organization's financial data, leading to data breaches and potential financial loss.

4. Vendor Risk: The external audit firm itself could become a source of risk. If the firm doesn't have robust cybersecurity measures in place, your organization's data could be at risk due to vulnerabilities in their systems.

5. Loss of Control: Outsourcing an audit means entrusting sensitive financial information to a third party. This loss of control over data management and security practices might make your organization uncomfortable.

|

6. Non-Compliance with Regulations: If the external audit firm doesn't adhere to relevant data protection regulations, your organization could face legal and financial consequences for non-compliance.

7. Insider Threats: Outsourcing might involve interaction with the audit firm's employees who have access to your data. An unscrupulous or disgruntled employee from the audit firm could misuse or leak your organization's information.

8. Cross-Border Data Transfer: If the external audit firm is located in a different country, there might be legal and regulatory challenges related to cross-border data transfer and data protection.

|

9. Lack of Transparency: It might be difficult to ascertain the exact security practices of the audit firm. Without transparency, you might not have a clear understanding of how your data is being handled.

10. Data Retention: Once the audit is complete, the audit firm might retain your data for various purposes. This could expose your organization's sensitive information to additional risks.

To mitigate these risks, here are some steps you can take:

- Due Diligence: Thoroughly research potential audit firms, including their reputation, experience, and cybersecurity practices.

- Contractual Agreements: Ensure that the audit firm signs a comprehensive agreement that outlines data security measures, confidentiality, and compliance with relevant regulations.

- Data Encryption: Use encryption for data transfer and storage to prevent unauthorized access even if data is intercepted.

- Access Control: Limit the information provided to the audit firm to only what's necessary for the audit.

- Regular Audits: Periodically audit the audit firm's data security practices to ensure they align with your standards.

- Non-Disclosure Agreements (NDAs): Have the audit firm sign an NDA to legally bind them to confidentiality requirements.

- Cybersecurity Assessment: Assess the audit firm's cybersecurity practices to ensure they meet your organization's standards.

Ultimately, it's about finding a balance between the benefits of outsourcing and the security of your organization's sensitive financial information. Consulting with legal, IT, and cybersecurity experts can help you make an informed decision and implement proper security measures.

How Can I Address Security Concerns Regarding External Audit?

Top of Page

Addressing security concerns regarding an external audit is crucial to ensure the protection of sensitive data and maintain the integrity of your organization's operations. Here's a comprehensive approach to addressing these concerns:

1. Select a Reputable Audit Firm: Choose a well-established and reputable audit firm with a proven track record in conducting audits. Research their history, client reviews, and certifications to ensure their credibility.

2. Clearly Define Scope and Requirements: Work closely with the audit firm to clearly define the scope of the audit, including the data and systems they will access. Establish specific requirements for data handling, security protocols, and confidentiality.

3. Non-Disclosure Agreement (NDA): Have the audit firm sign a comprehensive non-disclosure agreement (NDA) that legally binds them to confidentiality requirements, ensuring they don't share any sensitive information with unauthorized parties.

4. Data Encryption: Ensure that all data shared with the audit firm is encrypted during transfer and storage. Encryption adds an extra layer of protection against unauthorized access.

5. Access Control: Limit the access of auditors to only the data and systems required for the audit. Implement strict access controls, granting them the minimum necessary privileges.

6. Secure File Sharing: Use secure file-sharing methods to transmit sensitive documents. Avoid sending confidential information through unsecured channels like email.

7. On-Site Audit Procedures: If the audit involves on-site visits, establish protocols for the physical security of data and documents. Monitor their access to sensitive areas and systems.

8. Data Anonymization: Where possible, anonymize or mask personally identifiable information (PII) before sharing data with auditors. This minimizes the exposure of sensitive information.

9. Secure Communication Channels: Use encrypted communication channels for any discussions or correspondence related to the audit. Avoid discussing sensitive matters through unsecured means.

10. Regular Monitoring: Keep track of the audit firm's activities and the data they access. Regularly review logs and activity reports to ensure compliance with the agreed-upon scope.

11. Data Retention Periods: Clearly define how long the audit firm can retain your organization's data after the audit is complete. Ensure that data is securely deleted or returned at the end of the engagement.

12. Cybersecurity Assessment: Assess the audit firm's cybersecurity practices and data protection measures. Ensure that they have robust security protocols in place to safeguard your data.

13. Internal Communication: Inform your internal team about the audit, its purpose, and the security measures in place. Address any concerns or questions they might have.

14. Review Auditors' Findings: After the audit, review the findings and recommendations with the audit firm. This helps ensure that both parties are on the same page regarding potential security vulnerabilities.

By implementing these measures, you can effectively address security concerns associated with external audits and ensure that your organization's sensitive data remains protected throughout the audit process.

How Can I make My Accounts Payable Team Comfortable with the Idea of an External Audit?

Top of Page

Getting your Accounts Payable (AP) team comfortable with the idea of an external audit requires clear communication, transparency, and an emphasis on the benefits that such an audit can bring. Here's a step-by-step approach to help ease their concerns:

1. Open Communication:

- Explain the Purpose: Clearly communicate the reasons for conducting an external AP audit. Emphasize that the goal is to improve processes, ensure accuracy, and strengthen the organization's financial health.

- Address Concerns: Give your team the opportunity to voice their concerns and questions. Address these concerns openly and provide reassurance about data security, confidentiality, and the audit process.

2. Education:

- Explain the Process: Walk your AP team through the entire audit process. Describe what the auditors will be looking for, what documents they might need, and the overall timeline.

- Benefits of Audit: Highlight the potential benefits of the audit, such as improved efficiency, better processes, enhanced compliance, and a more accurate financial picture.

3. Highlight Transparency:

- Data Security Measures: Explain the measures in place to ensure data security during the audit. Detail encryption, access controls, and any other security protocols that will be followed.

- Confidentiality: Emphasize that confidential data will be handled with the utmost care and will only be used for the audit purposes.

4. Involve Them:

- Collaboration: Involve your AP team in the audit process. Their input can be valuable in identifying pain points, inefficiencies, and areas for improvement.

- Team Representatives: Designate a team member or two as representatives who can liaise directly with the auditors. This can make the process feel more collaborative.

5. Training and Preparation:

- Training: Provide any necessary training to your AP team to ensure they understand how to prepare for the audit, what documents will be needed, and what they can expect.

- Documentation: Help your team gather and organize all relevant documentation beforehand, so the audit process runs smoothly.

6. Clear Expectations:

- Timeline: Provide a clear timeline for the audit process. Knowing what to expect and when can help ease anxiety.

- Follow-Up: Let your team know that you will communicate any findings or recommendations from the audit and that their input will be valued in implementing improvements.

7. Recognize Their Efforts:

- Acknowledgment: Acknowledge your AP team's efforts in preparing for the audit. Recognize their hard work and dedication to ensuring a smooth process.

- Post-Audit Celebration: After the audit is complete, celebrate the successful collaboration and improvements made based on the audit findings. This can help foster a positive outlook toward future audits.

Remember, the key is to create an environment of trust, where your AP team feels respected and valued throughout the process. Regular communication, addressing concerns, and demonstrating the positive impact of the audit can go a long way in making your team comfortable with the idea of an external audit.

What Would Be A Healthy Attitude Towards the Errors that an Accounts Payable Audit Might Uncover?

Top of Page

A healthy attitude towards the errors that an Accounts Payable (AP) audit might uncover involves a constructive and solution-oriented approach. Here's how you can foster a positive attitude towards errors discovered during an AP audit:

1. Acknowledge Errors as Learning Opportunities: View errors as opportunities to learn and improve. Mistakes happen, and they provide valuable insights into areas that need attention. Emphasize that the goal is not to assign blame but to identify weaknesses and enhance processes.

2. Stay Calm and Professional: Maintain a calm and professional demeanor when errors are uncovered. Avoid assigning blame or reacting emotionally. Instead, focus on understanding the root causes of the errors and working towards effective solutions.

3. Foster Accountability: Encourage accountability among your team members. When errors are discovered, encourage individuals to take ownership of their mistakes and collaborate on finding solutions. This helps build a culture of responsibility.

4. Collaborative Problem-Solving: Involve your team in brainstorming solutions. Create an environment where team members feel comfortable discussing errors openly and working together to devise effective strategies to prevent similar errors in the future.

5. Focus on Process Improvement: Shift the focus from blame to process improvement. Emphasize that the audit's purpose is to identify areas where processes can be enhanced, resulting in more accurate and efficient operations.

6. Implement Corrective Measures: Once errors are identified, take swift action to implement corrective measures. Ensure that these measures are well-documented, communicated to the team, and integrated into the updated processes.

7. Celebrate Positive Changes: When errors lead to process improvements, celebrate these positive changes. Recognize the team's efforts in addressing issues and working towards creating a more robust AP process.

8. Encourage Continuous Learning: Errors can be opportunities for professional growth. Encourage your team members to seek additional training, attend workshops, or access resources that can enhance their skills and prevent future errors.

9. Emphasize Transparency: Create an environment of transparency where team members feel comfortable reporting errors without fear of retribution. This openness allows issues to be addressed promptly, reducing the likelihood of recurring errors.

10. Communicate with Stakeholders: If errors have affected vendors or other stakeholders, communicate transparently about the steps being taken to rectify the situation. This builds trust and demonstrates your commitment to resolving issues.

Remember that errors are a natural part of any process, and they can lead to valuable improvements when addressed appropriately. A healthy attitude towards errors involves a commitment to continuous improvement, a focus on collaboration, and a dedication to maintaining the highest standards of accuracy and efficiency in your AP processes.

Is The Notion That 'We Don't Make Mistakes' an Unhealthy One for an AP Department?

Top of Page

Yes, the notion that "We don't make mistakes" is generally considered unhealthy, especially for an Accounts Payable (AP) department. Here's why:

1. Unrealistic Expectations: No department or individual is immune to making mistakes. Claiming that mistakes never happen can create unrealistic expectations and put undue pressure on your AP team. This can lead to stress and fear of reporting errors.

2. Lack of Accountability: If the attitude is that mistakes never occur, team members might be less likely to admit errors or address them promptly. This lack of accountability can hinder the identification and resolution of issues.

3. Hinders Learning and Improvement: Mistakes provide opportunities for learning and process improvement. A culture that denies mistakes can prevent the organization from learning from its errors and implementing necessary changes.

4. Stifles Innovation: In an environment where admitting mistakes is discouraged, employees might become hesitant to propose new ideas or innovative solutions for fear of potential backlash.

5. Lack of Transparency: Pretending that mistakes don't happen can create a lack of transparency within the department. This can lead to hiding errors rather than addressing them, which can have serious consequences in the long run.

6. Negative Impact on Morale: Employees may feel pressured to hide mistakes to uphold the idea that the department is flawless. This can lead to a culture of secrecy and negatively impact morale.

7. Missed Growth Opportunities: Mistakes are valuable opportunities for growth. Discussing errors openly and finding solutions together can foster teamwork and personal development.

A healthier approach involves acknowledging that mistakes can happen, even in the most well-managed departments. Creating an environment where errors are treated as learning experiences and opportunities for improvement can lead to a more transparent, accountable, and innovative AP team. Encourage open communication about mistakes, address them constructively, and work collectively to prevent their recurrence.

Should We Welcome External Audit as a Professional Safety Net?

Top of Page

Yes, welcoming an external audit as a professional safety net can be a very beneficial attitude, especially for departments like Accounts Payable (AP). Here's why:

1. Objective Assessment: External auditors provide an unbiased and objective assessment of your AP processes. Their independent perspective can identify issues that might have been overlooked internally.

2. Error Detection and Prevention: Audits help identify errors, discrepancies, and potential fraud. By addressing these issues early, you can prevent financial losses and ensure accuracy in your financial records.

3. Process Improvement: Auditors often provide recommendations for process improvements. These suggestions can streamline your AP operations, making them more efficient and effective.

4. Strengthening Internal Controls: An audit highlights weaknesses in your internal controls. Addressing these weaknesses enhances your control environment, reducing the risk of errors and fraud.

5. Regulatory Compliance: External audits can ensure that your AP processes are compliant with relevant regulations and standards, reducing legal and financial risks.

6. Transparency and Trust: Embracing audits demonstrates transparency in your operations. This can enhance trust among stakeholders, including management, investors, and customers.

7. Professional Development: Audits provide opportunities for your team to interact with professionals from outside the organization, exposing them to different practices and fostering professional growth.

8. Validation of Efforts: A successful audit validates the hard work your AP team puts into maintaining accurate and efficient processes. It's a recognition of their commitment to excellence.

9. Early Detection of Issues: Audits can uncover small issues before they become major problems. This proactive approach saves time and resources in the long run.

10. Peace of Mind: Knowing that an external audit is in place can provide assurance that your financial operations are being monitored and evaluated by experts.

By viewing external audits as a safety net, you create an environment of continuous improvement and accountability. It's an opportunity to showcase your department's strengths, identify areas for growth, and demonstrate your commitment to accurate financial reporting.

In Conclusion

Top of Page

An Accounts Payable Audit is a thorough examination and review of an organization's accounts payable processes, transactions, and financial records. The purpose of this audit is to assess the accuracy, completeness, and compliance of accounts payable activities within an organization.

During an accounts payable audit, auditors typically perform the following tasks:

1. Verification of Documents: Auditors review invoices, purchase orders, receiving reports, and other relevant documents to ensure they are accurately recorded and supported by proper documentation.

2. Accuracy Check: Auditors verify the accuracy of data entered into the accounting system, such as invoice amounts, due dates, payment terms, and vendor details.

3. Internal Controls Evaluation: The audit assesses the effectiveness of internal controls in place to prevent fraud, errors, or misuse of funds. This includes reviewing segregation of duties, authorization processes, and approval hierarchies.

4. Duplicate Payments: Auditors examine payment records to identify any duplicate payments made to vendors or errors in payment amounts.

5. Compliance Review: The audit ensures that accounts payable processes adhere to relevant laws, regulations, and organizational policies. This may include reviewing compliance with tax laws, vendor contract terms, and payment terms.

6. Vendor Management: Auditors assess the vendor management process, including vendor selection, onboarding, and ongoing monitoring, to ensure compliance and mitigate risks.

7. Unrecorded Liabilities: The audit aims to identify any unrecorded liabilities, such as outstanding invoices or accruals that have not been properly recognized in the financial statements.

8. Data Analysis: Auditors may perform data analytics to identify patterns, anomalies, or potential areas of concern in the accounts payable data.

9. Reporting: At the end of the audit, auditors provide a detailed report summarizing their findings, including any control weaknesses, compliance issues, or recommendations for improvement.

An accounts payable audit helps organizations ensure the accuracy of their financial records, mitigate fraud risks, maintain compliance, and identify process improvements to enhance efficiency and effectiveness in the accounts payable function.

An accounts payable recovery represents a valuable opportunity for businesses to improve their financial performance, optimize cash flow, and establish stronger vendor relationships. By implementing effective strategies, such as automated systems, regular audits, proactive communication, and data analysis, organizations can reclaim lost revenue, enhance efficiency, and strengthen their overall financial position. Embracing accounts payable recovery as an integral part of financial management ensures that no funds go unaccounted for, enabling businesses to thrive in an increasingly competitive marketplace.